Jianfeng Guo, Fu Gu, Yinpeng Liu, Xi Liang, Jianlei Mo & Ying Fan

Published in:Nature Communications

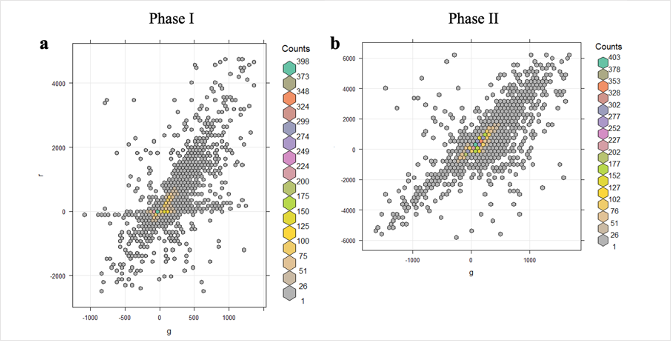

Abstract:The EU Emission Trading System (ETS) is the oldest and currently the largest carbon market in the world, but its purpose of stimulating carbon emissions via trading profits remains unexamined. Based on the complete firm-level transaction records of the EU ETS Phases I and II, here we show that the participating firms’ trading profits and their emission abatements are positively correlated, and the correlation becomes stronger in Phase II than Phase I. Specifically, we observe that non-linearity exists in the correlation; higher firm-level emission abatements can realize larger trading profits. This pattern affects the market fairness, though it may be helpful to incentivise emission abatements. The correlation is more regulated in Phase II than it is in Phase I, thereby indicating that the Phase II is more mature. We also observe that the state-level abatements are largely driven by industrial giants.

Website:https://www.nature.com/articles/s41467-020-15996-1

About the author:

Prof. Dr. Ying Fan is the Dean of the School of Economics and Management at Beihang University, and the Director of the Center for Energy and Environmental Policy Research, a joint research center sponsored by CAS, CNPC and Beihang University. She has received important awards such as Changjiang Scholar, National Science Grant for Distinguished Young Scientists, CAS Hundred Talents Program, and Special Government Allowance sponsored by the State Council. She is currently the Vice President for Academic Affairs of the International Association for Energy Economics (IAEE), Vice President of theChinese Society of Optimization, Overall Planning and Economic Mathematics (OOPEM), and President of the Chinese Society of Low Carbon Development Management.She has long term research experience in the field of energy economics and management, completed valuable works on Energy-Environment-Economy systems modeling and policy analysis.